Email Us:

Call Licensed agent

(844) 619-9500

Email Us:

Call Licensed agent

(844) 619-9500

Congrats on making it to 65! Time to pick a Medicare plan—because cake and candles aren’t the only choices you get to make this year!

G2 | Agency offers a wealth of financial solutions from leading carriers to fit every budget. Solutions are customized for your needs and easy to obtain — from application to policy issue to leveraging their benefits when you need them most.

*** We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact: Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Turning 65 brings a major milestone: becoming eligible for Medicare. If you're unsure about how Medicare works or which plan to choose, this guide will answer the most common questions people have whe... ...more

Medicare

September 08, 2024•3 min read

Discover the key differences between Original Medicare and Medicare Advantage. This post compares coverage, costs, flexibility, and benefits to help you decide which option best suits your healthcare ... ...more

Medicare

September 05, 2024•5 min read

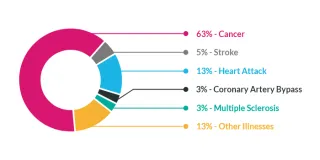

Critical Care Insurance offers financial protection during major health emergencies like heart attacks, cancer, or strokes, covering medical and non-medical expenses, helping you focus on recovery wit... ...more

Medicare ,Critical Ilness

September 05, 2024•4 min read

Explore the benefits of Dental, Vision, and Hearing Insurance to protect your long-term health. Learn how this specialized coverage helps lower costs and ensures comprehensive care for better quality ... ...more

Medicare ,Dental Vision & Hearing

September 04, 2024•3 min read

Discover the key Medicare changes coming in 2025 and how they impact Californians. From lower prescription costs to enhanced telehealth services, stay informed to make the best healthcare choices in t... ...more

Medicare ,Long-Term Care

September 02, 2024•4 min read

Why Working With a

Broker is Better!

G2 | Agency offers a wealth of financial solutions from leading carriers to fit every budget. Solutions are customized for your needs and easy to obtain — from application to policy issue to leveraging their benefits when you need them most.

Working with an insurance broker when choosing a Medicare plan offers personalized guidance that ensures you select the best coverage for your unique needs. Unlike direct enrollment or online comparisons, a broker provides expert knowledge of the various plans, helping you navigate the complexities of Medicare. They can tailor recommendations based on your health, budget, and preferences, ensuring you get the most comprehensive and cost-effective plan. Plus, brokers often have access to exclusive options and can offer ongoing support as your needs evolve.

What is Medicare Part A?

Medicare Part A helps cover your inpatient care in hospitals, critical access hospitals, and skilled nursing facilities (not custodial or long-term care). It also helps cover hospice care and some home health care. You must meet certain conditions to get these benefits.

Cost: Most people don't have to pay a monthly payment, called a premium, for Part A. This is because they or a spouse paid Medicare taxes while they were working. If you (or your spouse) didn't pay Medicare taxes while you worked and you are age 65 or older, you may be able to buy Part A.

What is Medicare Part B?

Medicare Part B: helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem.

Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount.

If you don't sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty.

What is Medicare Part C?

A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A (Hospital Insurance) and Part B (Medical Insurance) coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage (Part D).

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services (like whether you need a referral to see a specialist or if you have to go to only doctors, facilities, or suppliers that belong to the plan for non‑emergency or non-urgent care). These rules can change each year.

What is Medicare Part D?

Medicare Part D is Prescription Drug Coverage. Since January 1, 2006, everyone with Medicare, regardless of income, health status, or prescription drug usage has had access to prescription drug coverage. For more information about this program, please visit: http://www.medicare.gov/part-d/index.html

You may also call:

1-800-MEDICARE

(1-800-633-4227)

TTY: 1-877-486-2048 24 hours a day, 7 days a week!

Pays off your mortgage in the event of death, disability, or critical illness. It ensures your family can stay in your home without financial strain, providing a targeted benefit that decreases with your mortgage balance, offering peace of mind and security

They provide guaranteed minimum returns linked to a stock market index, combining growth potential with stability. This ensures steady income and peace of mind for retirees.

These annuities can offer growth, but it's important to know what you're buying.

Term Life Insurance provides affordable coverage for a set period, paying a death benefit if the policyholder passes away during the term. It's a cost-effective way to protect loved ones and secure financial stability.

Covers funeral and burial costs, offering a simple and affordable way to ease financial burdens on loved ones. It ensures that end-of-life expenses are covered, providing peace of mind and financial protection.

Insurance that provides income protection if you're unable to work due to illness or injury. It replaces a portion of your income, helping you maintain financial stability and cover essential expenses during recovery.

Offers financial support if you're diagnosed with a severe illness, such as cancer or heart disease. It provides a lump-sum payment to cover medical expenses and living costs, easing the financial burden during a challenging time.

Ensures a stable income during retirement by safeguarding your savings from market volatility and unexpected expenses. It helps maintain financial security and provides peace of mind, allowing you to enjoy your retirement without financial worries.

Provides early financial protection for children, offering benefits like savings for future education and coverage for unexpected health issues. It’s designed to give families peace of mind and secure a financial foundation for their child's future.

Promotes strategies focus on eliminating debt and building financial security. By managing and reducing debt, you can achieve financial freedom, enhance your savings, and create a more stable and stress-free financial future.

Todd Gorman

CA License # 0C72954

NPN #3146641

4883-B Ronson CT, San Diego, CA 92111

(844) 619-9500

G2 | Agency ©2025

Not affiliated with the U. S. government or federal Medicare program.

We do not offer every plan available in your area. Any information we

provide is limited to those plans we do offer in your area.

Please contact

to get information on all of your options. ( TTY 1-877-486-2048 )

Jane Doe

Satisfied Customer

Jane Doe

Satisfied Customer

Jane Doe

Satisfied Customer

Jane Doe

Satisfied Customer